It’s now close to three and a half years ago that the secondary watch market achieved its spectacular—or some might say infamous—high point in March 2022. This heady period saw ever higher values paid for the most coveted pre-owned and ‘grey market’ watches such as the Patek Philippe Nautilus ref. 5711/1A-010 in steel. Since then the market has cooled off with economic pressures such as higher interest rates, increased borrowing costs and inflation hitting home. Watches also lost some of their shine as a ‘golden goose’ investment commodity that could be limitlessly traded for profit.

So what does the secondary watch market look like now? To obtain some insight I take a look at the latest Chrono24 ‘ChronoPulse – Watch Index’ as well as covering the thoughts of Ben Staniforth, UK Country Manager at Watchfinder & Co.

Secondary Watch Market Insights

The secondary watch market in 2025 – some comments

Why do markets for collector items, such as watches, jewellery, art, cars, and furniture sometimes alter rather than stay buoyant all the time? In basic terms three factors can impact markets either individually or collectively.

Firstly, collector tastes change over time. For example, where once the pocketwatch reigned supreme as the must have collector item, now it is the wristwatch that has taken this prize position. Indeed, with the price of gold on the up recently I am sure many antique gold cased pocket watches will have been sent for scrap just for their gold value alone.

Secondly collectors in certain circumstances can start to lose confidence in the market. They might for example feel items are too over heated or hyped beyond their actual value. Famously this happened in 1637 in the Netherlands when the ‘Tulip Bubble’ burst for tulip bulbs which had been traded for fortunes.

Thirdly markets can be adversely impacted by an external shock typically economic in nature or geo-political. It is predominantly the latter two, initially from economic impacts, which caused the secondary watch market to dip post March 2022. But it is important to put this in context and to note that watches have not been the only luxury collector market impacted recently.

The excellent annual Wealth Report publication produced by leading global property consultancy Knight Frank noted in their 2025 report about the art market:

“Looking just at auction sales from the big three houses, Sotheby’s, Christie’s and Phillips, we can see that global art sales peaked at US$7.8 billion in 2022, after a two-year climb from the Covid low, but by 2024 volumes had slumped by 48% to US$4.1 billion."

The graph pictured above is a snapshot as of 22 August 2025 of the Chrono24 ‘ChronoPulse Watch Index’ tracker. Chrono24 is one of the world’s largest online marketplace trading platforms for the secondary watch market with listings of pre-owned watches from both the trade and private sellers alike. Chrono24 note that since 2003 over 1.6 million watches have been sold via their platform.

Updated daily their ChronoPulse Watch Index is based on data from the pre-owned watch market's 14 bestselling brands over the last three years. Each brand's top 10 bestselling and most important models are used for the index. In turn the index tracks the sales prices of 140 watch models measuring changes in price levels. The selection and weighting of individual brands and watch models used in the index is updated every six months. All this makes for a very useful tool for helping observe trends across the secondary watch market. It should be noted however that the tracker predominately focusses on modern pre-owned watches not the vintage market.

The ChronoPulse Watch Index snapshot above clearly shows the cooling off within the secondary watch market since the highpoint in March 2022. Effectively overall prices for the most traded pre-owned watches have slipped back to their values achieved in July 2021. This observable downward trend is therefore not a crash as such but reflective rather of the heat coming sharply out of the market. Indeed it has been widely noted that this correction was needed for the benefit of collectors over speculators. Notably the graph shows a somewhat flatter and calmer line since mid-2024 with a slight temporary uptick in January 2025.

In order to obtain further insight, in addition to the Chrono24 ChronoPulse Watch Index, I wanted to also include the view of a pre-owned dealer regarding the market. What better way to do this than to ask Watchfinder & Co. Founded in 2002 the brand has helped redefine, improve and modernise the pre-owned watch market and buyer experience. Now part of the Richemont Group, Watchfinder & Co’s boutiques can be found as far afield as New York, Doha and even Geneva.

So, what are their thoughts on the secondary watch market for pre-owned watches? Kindly commenting for this article Ben Staniforth, UK Country Manager at Watchfinder & Co observed that:

“We have seen a natural stabilisation following the unprecedented bubble of the pandemic era. The current market represents a healthy recalibration rather than a fundamental weakness. UK watch buyers focus on tangible quality, lasting value, and global reputation, prioritising traditionality… That said, the pre-owned market still faces two significant challenges: counterfeiting and watch theft. Counterfeiting in particular has reached alarming levels, with an estimated 40 million fake watches circulating globally. In the UK alone, with more than a million people falling victim to scams involving counterfeit timepieces.”

Watchfinder & Co have recently noted their ‘Most Wanted List’ of 20 ‘in-demand’ pre-owned watches. Given the subject of this article I thought it would be useful to include the list for reference. Traditionally popular models such as the Omega Seamaster and Rolex Submariner have now been joined by watches from Tudor such as the Black Bay 58 and Pelagos models.

Cartier Santos: WSSA0018 |

Rolex GMT Master II: 126710 BLNR |

Cartier Santos: WSSA0039 |

Rolex Submariner: 116610 LN |

Omega Speedmaster: 311.30.42.30.01.005 |

Rolex Submariner: 116613 LB |

Omega Seamaster: 210.30.42.20.01.001 |

Rolex Submariner: 16613 |

Omega Seamaster: 210.32.42.20.06.001 |

Rolex Submariner: 124060 |

Omega Planet Ocean: 2201.50.00 |

Rolex Explorer: 124270 |

Patek Philippe Nautilus: 5167A-001 |

TAG Heuer Monaco: CAW211R.FC6401 |

Patek Philippe Nautilus: 5712 |

Tudor Pelagos: M25600TN-0001 |

Rolex Air-King: 116900 |

Tudor Pelagos: M25600TB-0001 |

Rolex Daytona: 116500 LN |

Tudor Black Bay 58: M79030N-0001 |

(In alphabetical order. Reproduced with Watchfinder & Co permission. The above list is dated as of 21 August 2025.)

Watchfinder & Co also produce a ‘Wrist Watch - Definitive Luxury Watch Ranking’ report that is well worth reading. The report is available via Watchfinder & Co.

Before moving on with this article to look at some of the other key trends currently occurring in the secondary watch market, I do want to comment on the important point raised by Ben Staniforth, UK Country Manager at Watchfinder & Co.

He notes the “significant challenges” of counterfeiting and watch theft. The issue of trust and confidence in the secondary watch market is vital for its health and cannot be taken for granted. To sustain the market buyer’s must be confident that they are buying the real deal, not a fake or stolen watch.

Witness the number of resources that the industry is already putting into this aspect. Watchfinder & Co for example have invested in a certified watch servicing centre to authenticate and service watches. E-Bay have introduced their ‘Blue Tick’ Authenticity Guarantee Badge. But perhaps most notably in a direct manufacturer intervention in the secondary watch market Rolex now has their Certified Pre-Owned Programme. Remember when buying a pre-owned watch you have every right to ask the seller about authenticity, originality and how you are protected against buying a stolen watch.

There is one potential ‘elephant in the room’ that needs to be raised with regard the future outlook of the secondary watch market which is occupying minds at the moment. This is what will be the impact on the watch market with regards the US Administration’s imposition of stinging 39% tariffs on exports of Swiss goods including luxury watches into the USA. Giving his opinion for this article Carsten Keller, CEO of Chrono24, has kindly provided a brief commentary on the potential impact of this tariff:

“Higher US tariffs will lead to price increases in the primary market, which will also push up prices in the secondary market both in the US and globally.”

An evolving market – emerging trends

When reviewing the post 2022 slowdown in the secondary watch market it would be wrong to simply say that the market has stagnated. Undoubtedly both dealers and collectors who purchased at the top of the market will have felt some financial pain if they subsequently sold in the falling market. But critically the fundamentals which gave rise to the secondary watch market in the first place are still present. Namely that buyers have shown they are willing to purchase pre-owned watches as previously demonstrated by the sustained growth in the secondary watch market over the last decade.

Collectors also still have a passion for watches, and this appears to be relatively undiminished. Since 2022 we have seen a number of key themes emerge in the secondary and vintage watch market which tell a story that is far wider and more complex than a simple narrative that the market went down after March 2022. I have listed some of these key themes below. Space does not allow for an extensive commentary on each theme so they are presented more as bullet points.

Firstly and importantly sections of the market have bucked the general trend and indeed displayed an upswing in momentum both in terms of value and in collector appetite. Witness for instance the continued rise of collector interest in independent watchmaking.

An example would be an F.P.Journe Répétition Souveraine with a striking smoked sapphire dial and exhibition displayed movement from 2023 that achieved USD $685,800, (£510,300), including buyer’s premium, setting a new auction record price for the model at Phillips in Association with Bacs & Russo, New York sale this June.

Another star for collectors has been rare vintage Cartier wristwatches. If you get a chance please visit the current Cartier exhibition at the V&A Museum. You will see why this fabled Maison has acquired the reputation that it enjoys.

Pictured above is a rare Cartier London, ref.1499, 18k gold octagonal wristwatch from circa 1974 auctioned in March this year by Dreweatts based in Newbury. Estimated at £4,000 - 6,000 it took an astounding £66,000 hammer price, (before buyer’s premium). But before you rush out to buy an expensive rare vintage Cartier you must do your research and talk with experts. This is a very niche collector area and even the slightest mistake such as purchasing a watch with a changed out dial can greatly impact value. The increased interest in Cartier watches generally, both vintage and modern, also mirrors current collector tastes towards smaller cased and slightly more dressy watches.

Speaking about the world of vintage watches another strong area of collector enthusiasm over the last few years has been a growing appreciation for watches from the 80s, 90s and early 2000s. These watches have been labelled ‘neo- vintage’. As much as anything a newer generation of collectors are looking beyond the well-known earlier period vintage collector staples to find new classics.

In November 2024, Phillips in Association with Bacs & Russo held in Geneva a thematic auction entirely devoted to rare fine ‘neo- vintage’ period watches titled, ‘Reloaded: The Rebirth of Mechanical Watchmaking, 1980-1999’. All 65 lots sold achieving a ‘white glove’ status for the auction. The total sale value was Swiss CHF 24.8M, (£22M).

An early and very important F.P. Journe, Tourbillon Souverain à Remontoir d’égalité, wristwatch from 1993 sold at the auction for an amazing Swiss CHF 7.3M (£6.5M), including buyer’s premium.

Anecdotally, in terms of trends, I would say that the influence of social media has also grown over the last few years since 2022. Like no doubt many readers—I follow multiple watch Instagram blogs and enjoy much of the content. Will social media and 'influencers' become the main voice of the watch community and the arbiter of future trends in the watch market?

Finally, a couple more thoughts on the current secondary watch market. As an observation the age of the ‘hype watch’ has not entirely ended. Take for example the newly released Rolex, Land-Dweller, ref.127334, in Oystersteel and white gold with a 40mm case. The Rolex website lists the current RRP price as £13,050. On Chrono24 you can find pre-owned or new unworn 2025 models for sale between £34,000 - £47,000. This is a premium of upwards of 2.6 times the RRP price. The reality is that all collector markets are influenced by scarcity and desirability. The degree of scarcity and desirability will determine how heated the market becomes.

As an additional thought, I can’t help but wonder how the 'bread and butter' secondary watch market for mid-level pre-owned luxury watches up to say £10,000 is currently fairing? This is for brands such as Breitling, IWC, Omega, Panerai, TAG Heuer and Tudor. Are consumers for these watches taking much more care when it comes to discretionary buying of luxury items making the market quieter. One thing is for sure there are some good deals around!

One national pre-owned dealer recently offered a 2022, Tudor Black Bay GMT, ref.79830 on a steel bracelet with full box and papers for a special deal of £1,676. The watch was sold within minutes of my seeing it online! Even the vintage watch market which has so long avoided much of the secondary market turbulence for modern pre-owned watches is not immune. I spotted this week a superb rare vintage Rolex Submariner, ref.1680 with a red script ‘Submariner’ dial from circa 1979 discounted down by 24% from £22,999 to £17,499 on a dealer website. If you are considering buying a vintage or pre-owned watch in the current market it may pay to ask if there are any deals to be had.

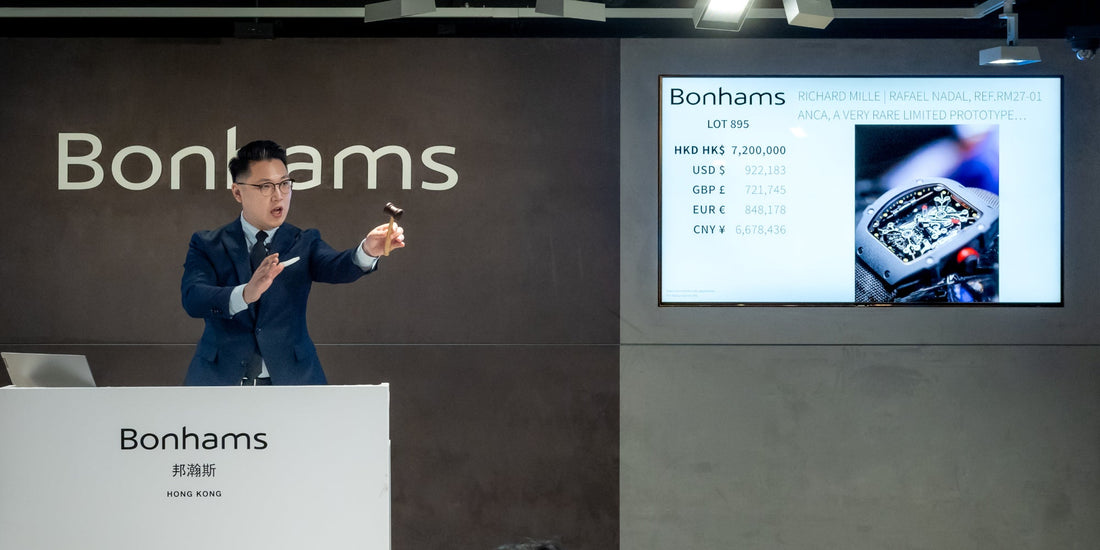

One potential beneficiary in the current market are auction houses. Buyers are always looking for a bargain or to find that rare watch they have always wanted. For sellers there is the chance to maximise their profit or at least make more than they would be offered by a dealer currently. So, in part two, we’ll hear from this key part of the market…

Banner Image — Bonhams Hong Kong Auction Scene. ©Photo courtesy of Bonhams.